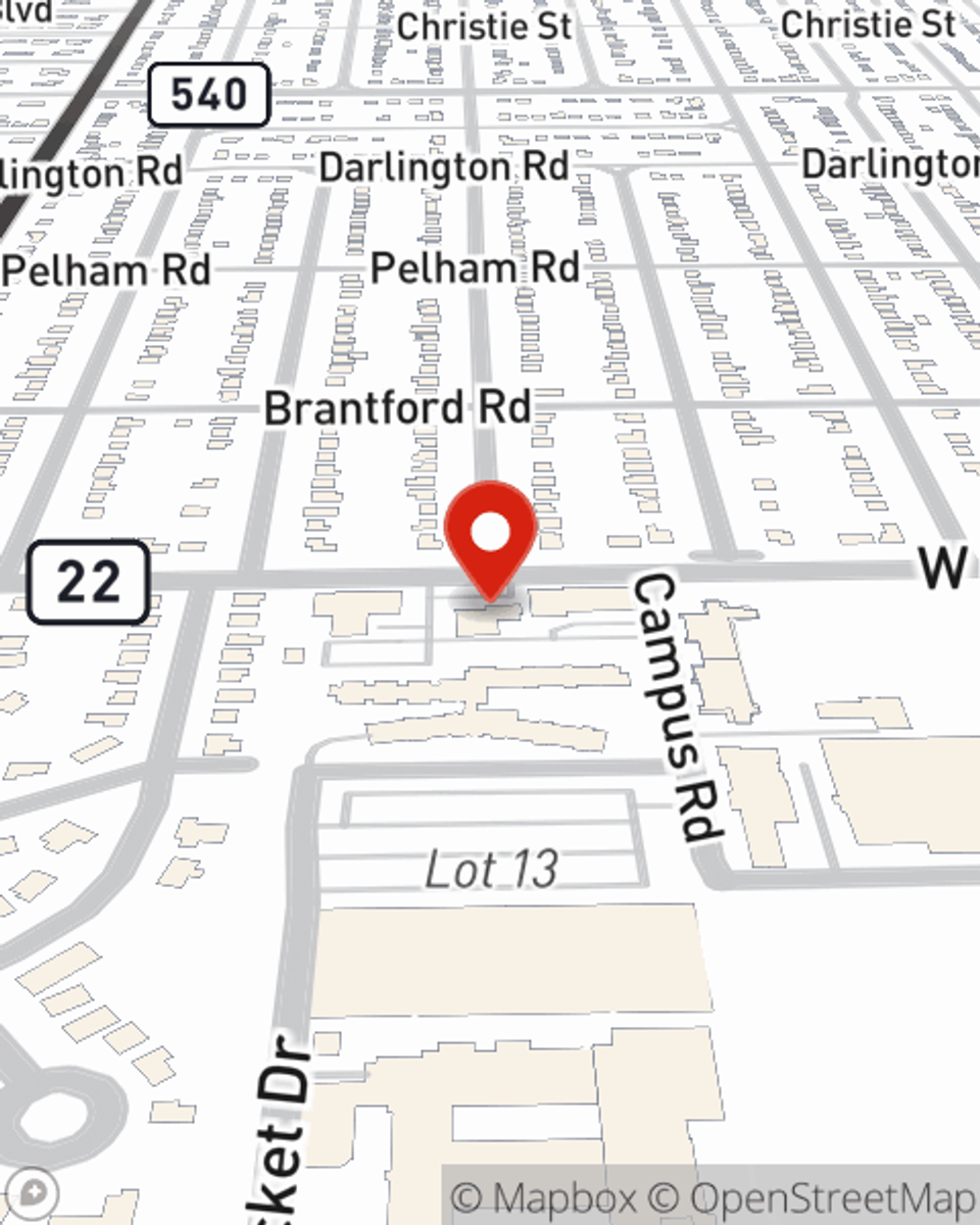

Renters Insurance in and around TOLEDO

Welcome, home & apartment renters of TOLEDO!

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

There’s No Place Like Home

You have plenty of options when it comes to choosing a renters insurance provider in TOLEDO. Sorting through deductibles and savings options to pick the right one is a lot to deal with. But if you want cost-effective renters insurance, choose State Farm for covering all of your belongings and personal items. Your friends and neighbors enjoy unbelievable value and straightforward service by working with State Farm Agent Jamie Mauntler. That’s because Jamie Mauntler can walk you through the whole insurance process, step by step, to help ensure you have coverage for everything you own inside your rental, including videogame systems, sound equipment, pictures, tools, and more! Renters coverage like this is what sets State Farm apart from the rest. Agent Jamie Mauntler can be there to help whenever the unexpected happens, to help you submit your claim. State Farm provides you with insurance protection and is here to help!

Welcome, home & apartment renters of TOLEDO!

Renters insurance can help protect your belongings

Safeguard Your Personal Assets

Renters insurance may seem like not a big deal, and you're wondering if having it is actually beneficial. But take a moment to think about what would happen if you had to replace all the valuables in your rented townhome. State Farm's Renters insurance can help when abrupt water damage from a ruptured pipe damage your personal property.

If you're looking for a committed provider that can help with all your renters insurance needs, contact State Farm agent Jamie Mauntler today.

Have More Questions About Renters Insurance?

Call Jamie at (419) 474-0559 or visit our FAQ page.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Jamie Mauntler

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.